Schedule a Call Back

MMR?s Most Vibrant Housing Markets ? Affordable to Ultra Luxury

2018-09-06

- Among top 7 cities, MMR saw most new launches ? nearly 13,600 units and highest sales at 15,200 units in Q2 2018.

- 17,220 promoters and 15,550 agents under MahaRERA ? highest RERA registration pan-India.

- Stamp duty increase may be a slight dampener in the short-term.

On the back of critical policy reforms like demonetisation, RERA and GST, 2018 is seeing both sales and new supply picking up across cities. Interestingly, the Mumbai Metropolitan Region (MMR) leads this trend. Anarock data indicates that out of the total new housing supply of around 50,100 units in Q2 2018 across the top 7 cities, MMR saw the highest number of new launches with nearly 13,600 new units ? a 59 per cent increase against the preceding quarter.

In terms of sales too, MMR clocked the maximum housing sales with approximately 15,200 units being sold in Q2 2018 ? an increase of 26 per cent against Q1 2018.

MMR?s top 3 micro markets across budget ranges 2017 - Q2 2018:

Affordable Segment (< Rs 50 lakh)

- Rasayani in Navi Mumbai saw the launch of nearly 2,410 units, with average prices being Rs 5,100 per sq ft and average property size being 450 sq ft.

- Palghar in Mumbai saw launch of nearly 1,710 units, with average prices hovering around Rs 4,550 per sq ft and average property sizes at around 380 sq ft.

- Panvel in Navi Mumbai, the third-most active micro market in MMR in this segment, saw the launch of nearly 1,510 units. The average property prices are Rs 6,700 per sq ft and average carpet area is 380 sq ft.

Mid Segment (Rs 50 lakh -Rs 1 crore)

- Kandivali in Mumbai saw as many as 2,300 units launched since 2017, with average prices at Rs 20,000 per sq ft and average size of 390 sq ft.

- Dahisar East in Mumbai saw launch of nearly 710 units with average prices at Rs 18,000 per sq ft and size at 470 sq ft.

- Shilphata in Navi Mumbai, another prominent locality for mid segment properties, that saw around 530 units launched with average prices at Rs 7,800 per sq ft and sizes at 630 sq ft.

(Source: ANAROCK Research)

Luxury Segment (Rs 1 crore - Rs 2.5 crore)

- Andheri East in Mumbai saw the launch of nearly 2,230 units with average prices and sizes hovering around Rs 27,400 per sq ft and 510 sq ft respectively.

- Mulund West in Mumbai saw the launch of nearly 960 units with average prices at Rs 27,400 per sq ft and average size at 650 sq ft.

- Seawoods in Navi Mumbai, the third most active locality in MMR in this segment, saw the launch of more than 200 units. Average property prices are Rs 12,500 per sq ft while the average carpet area is 1,050 sq ft.

Ultra-Luxury Segment (> ?2.5 Crore)

- Mazgaon in Mumbai saw launch of nearly 820 units with average prices and sizes hovering around Rs 65,000 per sq ft and 950 sq ft respectively.

- Tardeo in Mumbai saw launch of nearly 550 units with average prices at Rs 75,000 per sq ft and size at 800 sq ft. Sanpada in Navi Mumbai saw launch of more than 50 units. Average property prices are Rs 21,000 per sq ft while average carpet area is 1,250 sq ft.

Immediate Outlook: Maharashtra has emerged as one of the most active states in RERA implementation, and MahaRERA has been the primary driving force behind MMR?s regained momentum in 2018. In over a year, the authority has registered more than 17,220 promoters and 15,550 agents, the highest across the country.

While the proposal to levy a surcharge of 1 per cent on stamp duty (increasing to 6 per cent from the existing 5 per cent) could prove to be a slight dampener in the short-term, the decisive return of buyers to the market is beyond question.

About the Author: Anuj Puri is Chairman at Anarock Property Consultants.

Subscribe Now

Subscribe to our Newsletter & Stay updated

RECENT POSTS

Popular Tags

Folliow us

Related Stories

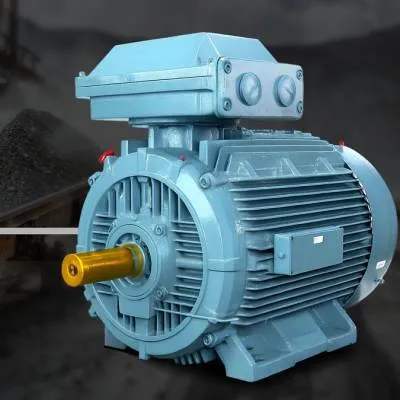

Ultra-Efficient Motors

ABB’s IE5 ultra-premium efficiency motors, India’s first IE5 range, deliver 45–1000 kW power without rare-earth metals. Designed for DOL an...

Centre Sets National Standards For Renewable Power Use

The Central Government, in consultation with the Bureau of Energy Efficiency (BEE), has issued a new notification establishing minimum renewable ...

Smart Solutions

Hikvision’s advanced Boom Barriers streamline access control and traffic management with AI-enabled automation. Offering telescopic, folding, a...