Schedule a Call Back

Digging Deeper, Cleaner, Smarter

2025-09-29

India’s mining equipment market has shifted decisively into an expansionary cycle. The inflection is anchored in rising mining activity across coal, iron ore, bauxite and limestone, coupled with a renewed thrust on domestic energy security and a sustained pipeline of infrastructure works that demands heavy hauling. While procurement cycles of large state-owned buyers still create year-to-year lumpiness, the underlying trajectory is clearly upward: bigger fleets, higher-capacity machines, cleaner powertrains, and deeper localisation are converging to reset the market at a higher base.

The context is straightforward. Coal remains essential for grid stability and peak demand; iron ore and limestone underpin steel and cement; and roads, metros, industrial corridors and urban projects continue to consume aggregates at scale. That cocktail is now translating into tangible order books for dump trucks, rigid and articulated haulers, mining excavators, dozers, graders, drill rigs, and underground packages. Financing access has improved, contractor tenures are lengthening, and mines are rationalising cost-per-tonne with smarter asset mixes. The result: capex decisions are increasingly proactive rather than merely replacement-driven.

Demand engines

Coal’s centrality to India’s power mix continues to pull through equipment demand. As domestic output targets rise, mine developers and operators are deploying larger fleets to move both coal and overburden efficiently. The result is visible in the dump truck park: after a post-2015 tilt to 51–60-tonne trucks, buyers have steadily migrated into the 81–100-tonne bands to compress cycle times and optimise unit economics. “The nature of projects is becoming larger and more complex, requiring heavier-duty vehicles,” notes Gagandeep Singh Gandhok, EVP, VE Commercial Vehicles (VECV). “We are witnessing a shift in customer preference towards high-capacity tippers and dump trucks, especially in remote mining areas.”

That shift is not confined to coal. Odisha’s iron ore belt and other ferrous clusters continue to support high-capacity hauling; limestone quarries feeding a capacity-expanding cement industry are similarly scaling up. In parallel, national highway packages, expressways, dedicated freight corridors and multi-modal logistics hubs are sustaining a large ecosystem of tippers, off-highway trucks and loaders that shuttle aggregates and sub-base materials. The broader point: even when a single large buyer’s tendering cadence pauses, multi-commodity mining plus infrastructure keeps underlying demand buoyant.

Domestic OEMs have aligned quickly. BEML—a bellwether for mining trucks—underscores the improved outlook. The company points to recent orders such as the Central Coalfields requirement as evidence of a strengthening cycle and reiterates the company’s focus on delivering state-of-the-art solutions for high-productivity mines. On the underground side, Gainwell Engineering (GEPL) has delivered India’s first domestically manufactured room-and-pillar package—its GCM345 continuous miner and GFB110 feeder breaker—produced at Panagarh, West Bengal, under a Caterpillar technology license and paired with global-grade shuttle cars, roof bolters and power centres. This is not just import substitution; it expands India’s capability set for faster underground deployment and lifecycle control.

Finance and operating models are also maturing. Longer-tenure contracts, structured maintenance agreements, parts availability guarantees and uptime-linked service level frameworks are increasingly common. As Sanjay Saxena, COO, Sany India, emphasises, rising power demand and the push for domestic coal—alongside steel and cement expansion—are consolidating a sustained, multi-year requirement for advanced machines. In short: the market is being re-rated upwards by fundamentals, not just a one-off tendering bulge.

Bigger, cleaner, more connected fleets

Scale is the most visible marker of change, but technology is the force multiplier. Mines are specifying higher payloads, but they are also asking for lower fuel burn, predictive maintenance, and safer, more ergonomic cabs. That is accelerating the adoption of electric, hybrid and ultra-efficient diesel solutions, as well as transmissions and drivetrains tuned for India’s duty cycles.

On the truck side, Sany India has introduced the SKT105E—a fully electric, 70-tonne open-cast mining truck built in India—signalling that zero-tailpipe hauling is entering mainstream trials in suitable duty cycles and charging ecosystems. Propel Industries has announced electric dumpers slated for launch within the next 18 months, featuring advanced motors, energy recovery and live telemetry for performance tracking. In engines, Kirloskar Oil Engines (KOEL) has unveiled India’s only 1100-HP mining engine alongside BS-V solutions for construction equipment—offering better efficiency and emissions control with maintainability for Indian conditions. “From India’s first CNG-powered air-cooled engines to locally manufactured 1100-HP mining engines, we will continue to bring practical, indigenously developed products,” says Rahul Sahai, CEO, KOEL.

Hybridisation is moving from pilot to proposition. Infra Engineers India (IEPL) has launched a dual electric–diesel hybrid excavator that lets operators switch at the push of a button. On a 20-tonne class excavator, the delta is striking: in typical Indian rates, an hour of diesel operation can cost approximately Rs 1,500, while electric power can be a quarter of that. Run a fleet for 400 machine-hours a month, and monthly savings can exceed Rs 4.5–5 lakh—before counting benefits like reduced noise, zero local emissions in tunnels/indoors, and lower maintenance from fewer oil and filter changes. This math is shifting procurement conversations from sticker price to total cost of ownership (TCO) and time-to-payback.

Safety and control are advancing in lockstep. BEML’s BH60M rear dump trucks now integrate 360-degree camera systems, automatic fire suppression and driver fatigue monitoring—features that directly cut incident risk and unplanned downtime. Kartik Ramanan, Executive Director – Global Off-Highway, Allison Transmission, frames the trend succinctly: “Safety has become a top priority. Improving driver comfort is directly linked to productivity, and autonomous vehicles are being explored to further enhance safety.” Indeed, autonomy pilots in hauling and drilling, AI-assisted dispatch, and condition-based maintenance are moving from slideware to site-proven tools, constrained mainly by connectivity, terrain variability and the economics of retrofits.

The emissions conversation is also broader than tailpipes. Global suppliers like Austin Engineering are pushing lighter, high-strength trays and buckets that increase payload and reduce fuel burn and tyre wear per tonne moved. “As sustainability pressures rise, design efficiency is the first fuel,” says Brad Higgins, General Manager Sales – APAC/EMEA, Austin Engineering. Internally, material optimisation, waste recycling and on-site renewables at fabrication shops are becoming part of the competitive narrative.

Bottom line

The direction of travel is unambiguous. Rising mining activity is lifting the Indian mining equipment market to a higher baseline. Larger, smarter, lower-emission machines are entering fleets; underground capability is being built domestically; finance and service models are maturing; and the workforce powering this transformation is becoming more skilled and more inclusive. Short-term volatility may persist as big buyers bunch orders and delivery schedules straddle fiscal years. But the fundamentals—energy security, commodity demand, infrastructure momentum, and TCO-driven technology adoption—are aligned for a multi-year upcycle.

For OEMs, contractors and mine owners alike, the mandate is clear: prioritise cost-per-tonne over sticker price, choose platforms that can scale capacity and lower emissions, build uptime into the commercial model, and invest continuously in people—engineers, operators, and maintainers—who turn machines into productivity. If India keeps compounding these advantages, the next decade won’t just be about more equipment in mines; it will be about a stronger, more self-reliant, and more future-ready mining ecosystem.

Subscribe Now

Subscribe to our Newsletter & Stay updated

RECENT POSTS

Popular Tags

Folliow us

Related Stories

Sinoboom CEO Addresses India’s MEWP Industry

Susan Xu, Owner and Group CEO of Sinoboom, recently addressed members of the Aerial Platform Association of India during a celebratory dinner hel...

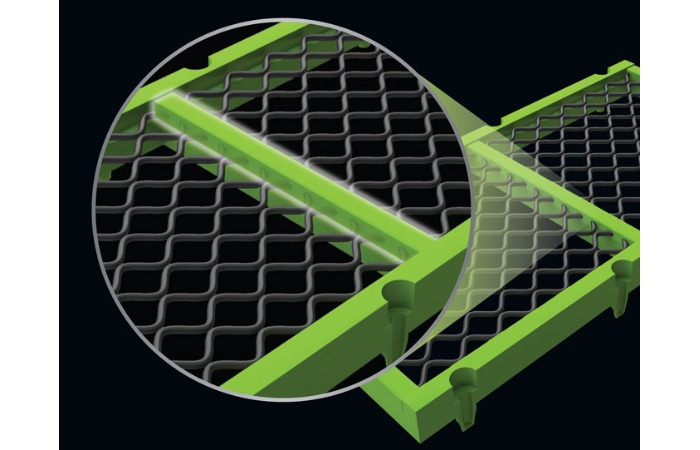

MAJOR Showcases Screen Media Technology at CONEXPO/CON-AGG 2026

MAJOR, a global manufacturer of high-performance wire screen media, will exhibit at CONEXPO/CON-AGG 2026, where it will showcase its screen media s...